A world leader in using hydrometallurgical processes to mine and refine nickel and cobalt – metals deemed critical for the energy transition.

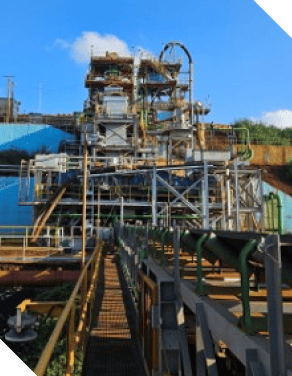

Sherritt is a Canadian-based company which mines, processes and refines nickel and cobalt through our 50% ownership in the Moa Joint Venture. Our vertically integrated joint venture includes our mining operations in Moa, Cuba and our refinery in Fort Saskatchewan, Alberta. Our nickel and cobalt products are sold worldwide (except in the United States).

As a by-product of our refining process, we produce agriculture fertilizer for sale in Western Canada through our wholly-owned fertilizer business.

Our Power division, through our one-third ownership in Energas S.A., is the largest independent energy producer in Cuba.

Our Purpose is to be a leader in driving growth and innovation in mining and refining, accelerating the transition to a low carbon world.

We strive to create a safe and rewarding workplace for our employees, deliver long-term value to our investors and foster lasting benefits for the communities where we operate.

We are a company guided by our Values. These Values not only anchor us but also inspire us. They influence our strategy, shape our culture, and provide a foundation for our long-term success.